SBFN Task Force for Low-income Member Countries

About this Task Force

The SBFN Task Force for Low-Income Countries was established in October 2018 under the Measurement Working Group to assess and support sustainable finance development and implementation in low-income (IDA)* SBFN countries.

The Task Force undertook a diagnostic study to understand the unique challenges and opportunities low-income countries face in sustainable finance, resulting in a Diagnostic Report, Necessary Ambition: How Low-Income Countries Are Adopting Sustainable Finance to Address Poverty, Climate Change, and Other Urgent Challenges, along with its 16 case studies, 8 country reports, and a set of tools to support decisions in developing and implementing sustainable finance roadmaps.

The work of the Task Force was concluded in 2023, and the Inclusive Sustainable Finance (ISF) Task Force was subsequently established as an expansion of the SBFN Task Force for Low-Income Countries.

Phase 1 — Assessing unique challenges and opportunities faced by SBFN IDA countries

Between November 2018 and June 2020, the Task Force undertook a diagnostic study to understand the unique challenges and opportunities related to sustainable finance initiatives in 11 low-income countries: Bangladesh, Cambodia, Ghana, Honduras, Kenya, the Kyrgyz Republic, Lao PDR, Mongolia, Nepal, Nigeria, and Pakistan.

The findings were published in the Diagnostic Report (June 2020), entitled Necessary Ambition: How Low-Income Countries Are Adopting Sustainable Finance to Address Poverty, Climate Change, and Other Urgent Challenges.

The report featured:

- 16 case studies

- A set of tools to support decisions in developing and implementing sustainable finance roadmaps

- 8 country reports (Bangladesh, Cambodia, Kenya, the Kyrgyz Republic, Mongolia, Nepal, and Nigeria)

In addition, the report uncovered four priorities that are identified by members as they connect sustainable finance with broader development ambitions:

- Environmental and social risk management (ESRM) by financial institutions

- Green finance

- Financial inclusion

- Agriculture & SME finance.

Phase 2 — Exploring the intersections between sustainable finance and financial inclusion

Responding to the priority of SBFN members to link sustainable finance and financial inclusion, SBFN has been collaborating with partners to develop conceptual frameworks and avenues for country support.

UNSGSA Inclusive Green Finance Working Group

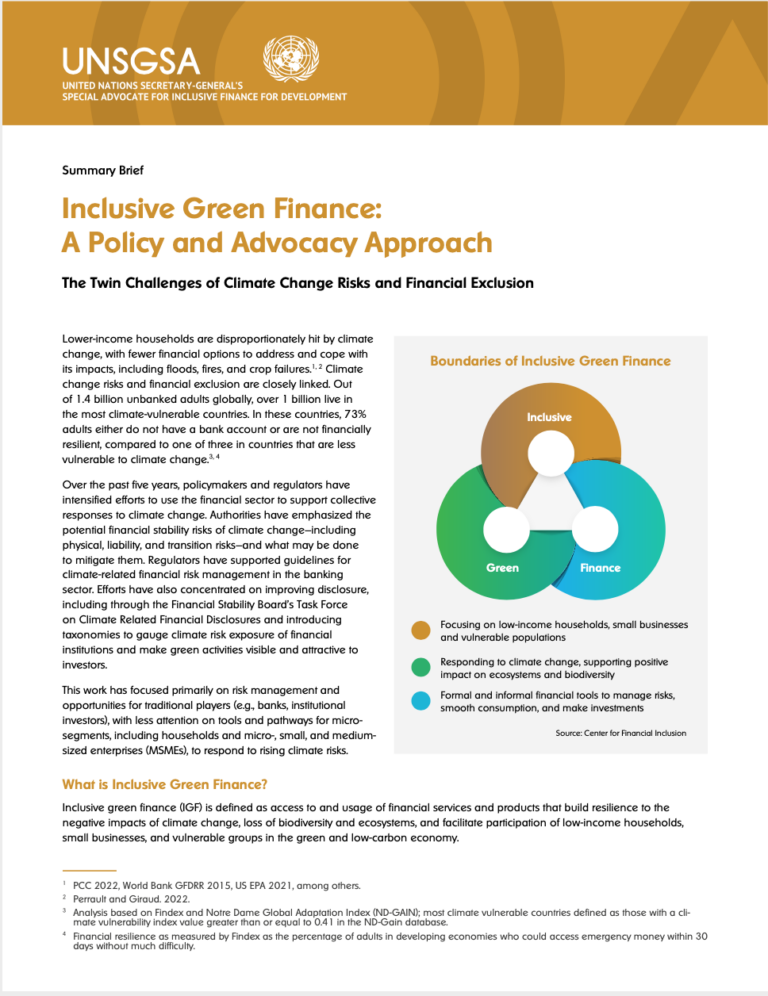

Between May 2022 and April 2023, SBFN, Center for Financial Inclusion, and the Alliance for Financial Inclusion participated in a working group on Inclusive Green Finance (IGF), spearheaded by Queen Máxima of the Netherlands in her capacity as United Nations Secretary-General’s Special Advocate for Inclusive Finance for Development (UNSGSA).

A key objective was to elevate the interdependent and amplifying role of financial inclusion in global sustainability efforts and strengthen climate considerations in financial inclusion plans and strategies. The working group also took stock of existing work on IGF to highlight good practices as well as identify gaps and how this can be supported through high-level advocacy and policy.

The working group produced a technical note presenting a policy and advocacy framework for IGF, emphasizing action by public and private stakeholders in three broad areas:

- Integration of IGF at the country level, including in defined national strategies or plans;

- Investment in information and data, including

- A research and evidence agenda

- IGF consideration in emerging tools such as green taxonomies, and

- Deepening IGF products/use cases

- Integrating IGF in the international regulatory/enabling environment for climate finance, including examining unintended consequences of climate finance policy on financial inclusion).

The policy note was published on May 15, 2023 and can be downloaded here.